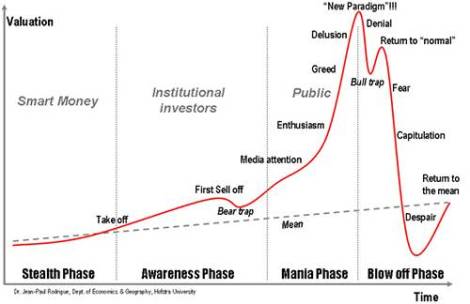

In 2006, Professor of Economics and Geography at Hofstra University Jean-Paul Rodriguez drew up the above chart to describe in human-terms the life-cycle of a bubble. Pretty, ain’t it?

If you follow the graph from the origin to the beginning of the ‘Blow off Phase’ you will notice that between the “Bull trap” and the “Return to ‘normal'” there is a small but not insignificant up-swing in Valuation before “Fear” and “Capitulation” set in. In financial trader-speak this period is known as a ‘dead cat bounce‘, owing to the macabre observation that “even a dead cat will bounce if it falls from a great height”.

Now each bubble will have its own unique life-cycle (and death-spiral) and it should be noted that the above graph is only intended as a generalised pattern – when this dead cat bounce will occur, how high it will bounce, or indeed if it will bounce at all, are all unknowns and given to varying degrees of uncertainty and speculation.

The point Tiberius is making is this: Who cares?

Either you believe the last ten years have seen the creation of an unprecendented Housing Bubble in this country (and the US) or you do not believe it – Tiberius is not trying to convince you of either. But let’s say for argument’s sake you fall into one of the two camps – you either think house prices in this country are grossly exaggerated (you are a Bear) or else they are reflective of the underlying strength in (and dynamics of) our economy and are therefore sustainable and likely to increase (you are a Bull).

So let us imagine you are a Bear who bought a property in 1996/7 (at the approximatie ‘Take off’ period) and who saw its value significantly increase until late 2007 (“New Paradigm!!!”). Over that period, this increase in value pleased you as it showed you had made a wise investment; however, being a cautious Bear, you were wary of it lasting and decided not to release any of your home’s equity.

The graph suggests that, if indeed we are witnessing the collapse of a Bubble, the valuation of your home would have to fall to below its 1996/97 levels (important: once inflation has been adjusted for) into the “Despair” period before eventually returning to the mean.

Are we anywhere near those levels yet? Obviously not.

So, with this in mind, how can the BBC be asking in all seriousness: “Are We at the Bottom Yet?“, or the Independent be wondering: “is now the time to buy, or is it wiser to hold fire until concrete evidence emerges that house prices are finally starting to rise again?“

As a Bear, you’d probably have realised that the ‘green shoots’ so often talked up by ‘property experts’ and ‘market analysts’ were nothing of the sort.

You’d look at graphs such as this one reported last week in the BBC:

And where some would see an up-turn and the promise of a brighter tomorrow, you’d see a nothing but the bounce of a dead cat.

But this is not to say you’d definitely be right. Bubbles are only really understood retrospectively.

There are others – The Bulls – who would believe in what they may call the market fundamentals – that there are not enough desirable homes for all those who want them and that, due to a growing population (significantly affected by immigration), there is a shortfall in supply and increasing demand – the main ingredients for growing valuations.

What many of these Bulls would suggest is that instead of looking at ‘the housing market’ as one homogenous entity, sharing a common destiny, one should look at the market in greater detail; only then would one realise that while certain sectors of the market that have undoubtedly ‘Bubbled’ of late (city centre off-spec flats being one of the more dramatic), there is still a dearth of adequately-built family homes. This is a more complex argument and more difficult to counter.

However, should you frequent the forums and discussion groups on housing prices (“That’s right”, admits Tiberius, “I have no life”), you will often hear people making a more Bullish argument for house prices – one that even acknowledges the Bubbly nature of the current markets. The argument goes that house prices in the mid to late 90s were not yet in the Stealth and Awareness Phase, but were, rather, still recovering from the ‘Blow Off Phase’ of the last housing crisis (late 80s/early 90s) . It follows from this that houses were undervalued until the early part of this century, and though we should expect a dip in prices, values will only drop to levels seen in these later years. Overly optimistic? Perhaps, but such is the nature of The Bull.

Whatever your perspective or persuation though, Tiberius says this: “A dead cat is still a dead cat – and, however high it bounces, it aint ever coming back to life”.

You have reached the Blog of Tiberius Leodis. Thanks for dropping by.

You have reached the Blog of Tiberius Leodis. Thanks for dropping by.

Leave a comment